A member of Association of Insurance Brokers of Kenya (AIBK)

We are Data Protection Compliant as per the Data Protection Act of 2019

A member of Association of Insurance Brokers of Kenya (AIBK)

We are Data Protection Compliant as per the Data Protection Act of 2019

Uncertainty & Security

“Your 1 Stop Insurance Solution” for all your Insurance needs

including but not limited to;

1. Consultancy and Risk Management

2. Intermediary/Broker Services

10 Years Anniversary

Why CSI

Vision

Prompt and proactive claim settlement

Personalized professional service

Consistency

Vision

“To be envisaged as a composite professional insurance service provider, by sourcing the most comprehensive, cost-effective insurance packages and delivering prompt underwriting and claims service with a proactive, positive attitude.”

Who is CSI?

Complete Solutions Insurance (CSI) Brokers Ltd is “Your 1 Stop Insurance Solution” for all your Insurance needs. We offer:

- Consultancy and Risk Management

- Intermediary/Broker Services

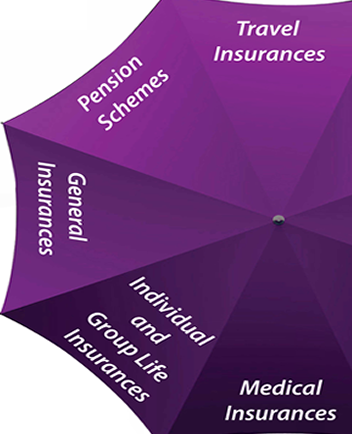

Our services include but are not limited to;

- General Insurances

- Medical Insurances – CSI Medicare

- Individual and Group Life Insurance

- Pension Schemes

- Travel Insurances

- Trade Credit Insurances

- Cyber Liability

- Tailor-Made Specific Insurance Packages

Our Product & Services

Your 1 Stop Insurance Solution

Motor Insurance

We provide covers for all categories including motor private, commercial, motorcycle.

Motor Insurance

Medical Insurance

We are a licensed MIP offering : corporate, SME, Micro ,Individual covers & community schemes .

Medical Insurance

Property Insurance

We have a wide range of products covering various assets such as building against insured perils.

Property Insurance

Marine Insurance

We offer the most reasonable marine cargo & hull insurance.

Marine Insurance

Need based tailored packages

We at CSI analyze client insurance needs and customize unique products befitting the needs.

Need based tailored packages

Liability Insurance

We have a range of products that take care of business related liabilities

Liability Insurance

Miscellaneous Insurance

we have various products to take care of business interests and liabilities that are not covered under the rest of the insurance classes.

Miscellaneous Insurance

Trade Credit Insurance

We facilitate this cover to protect risk handling clients against non-payments of commercial debt or related.

Trade Credit Insurance

CSI Products & Services

Home

Vehicles

Life

Business

Compare quotes and get life insurance in right way

Get an Insurance Quote

Reliable. Personable. Fast.

Start a fast, free auto insurance quote with Alico. We help you find any insurance coverages that are right for you, so you’re not paying for anything you don’t want!

Get a insurance quote – typically in 2 minutes or less. Switch to Alico for an insurance policy from a brand you can trust.

Facing any problem to get a quote!

Call: 1.888.255.4364

Our Partners

We’ve achieved awards and partnerships

Our business leaders have come a long way. There are numerous areas in which our business leaders, through their creativity & entrepreneurship.

CSI Registration as Data Processor

CSI 10 Years Anniversary